Millions of people across the United States depend on Social Security and Supplemental Security Income payments each month. These benefits help cover essential living costs such as food, rent, medicines, and utilities. Because these payments are so important, many beneficiaries want to know the exact February 2026 deposit dates and how the payment system works. Understanding the official schedule can reduce stress and help families plan their budgets more confidently.

This guide explains the February 2026 Social Security and SSI payment calendar in simple language, including who sends the payments, how the schedule is decided, how cost-of-living increases are included, and what to do if a payment does not arrive on time.

Who Sends Social Security and SSI Benefits Each Month

Social Security retirement benefits, Social Security Disability Insurance payments, and SSI benefits are all issued by the Social Security Administration. This federal agency manages benefit calculations, applies annual increases, verifies eligibility, and sends out monthly payments to qualified recipients.

Retirement benefits are meant for workers who have reached the required age and earned enough work credits during their careers. Disability benefits support people who cannot work because of a serious medical condition that meets program rules. SSI is different from retirement and disability programs because it is based mainly on financial need and limited resources rather than work history.

Even though these programs serve different groups of people, the payment process follows a regular monthly pattern that usually stays consistent from year to year.

SSI Payment Timing for February 2026

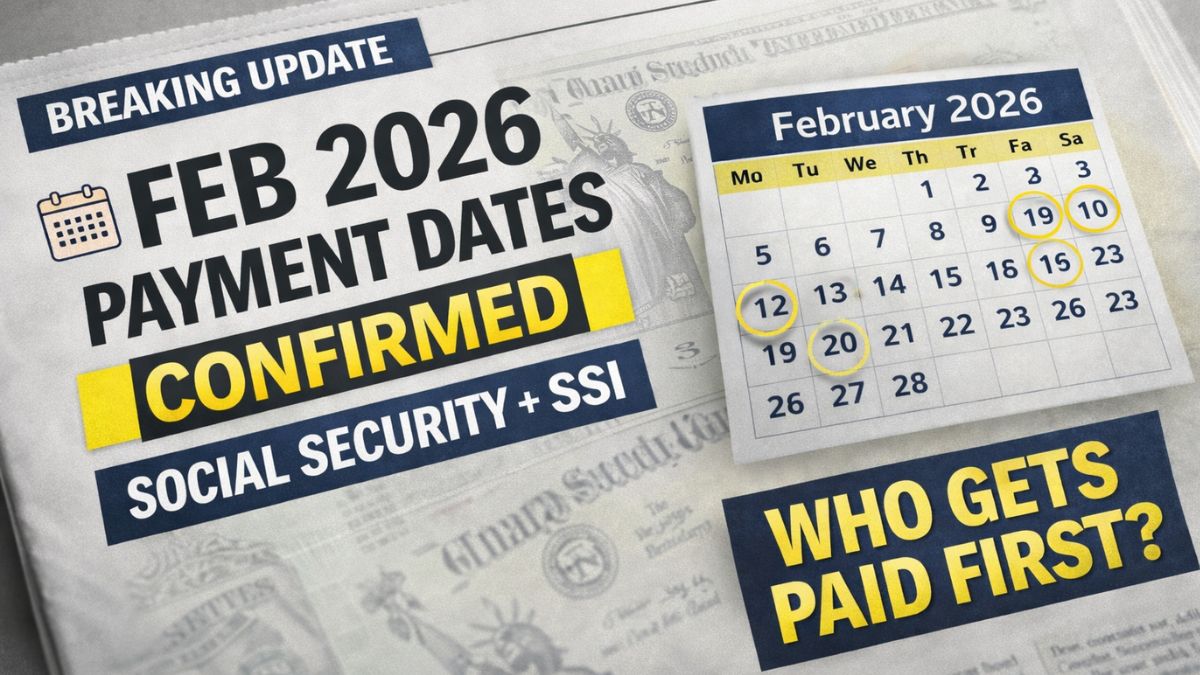

SSI payments are normally sent on the first day of each month. When the first day falls on a weekend or a federal holiday, the payment is usually issued on the previous business day instead. This adjustment is made so recipients do not have to wait extra days to receive their money.

For February 2026, beneficiaries should check the calendar and their bank deposit records to confirm the exact arrival date. In most cases, funds arrive through direct deposit, which is considered the fastest and most secure method. Some recipients still receive payments through Direct Express cards or other approved methods.

It is important for recipients to keep their banking information updated. If an account number or bank has recently changed and the update was not reported in time, the deposit could be delayed or returned.

Retirement and Disability Payment Schedule Based on Birth Dates

Social Security retirement and SSDI payments follow a Wednesday schedule that depends on the beneficiary’s date of birth. This system spreads payments across the month instead of sending them all at once.

People born between the first and the tenth of any month are generally paid on the second Wednesday. Those born between the eleventh and the twentieth are usually paid on the third Wednesday. Individuals born between the twenty-first and the thirty-first are typically paid on the fourth Wednesday.

There is also a long-standing exception. Beneficiaries who started receiving Social Security before May 1997 are usually paid near the beginning of each month rather than following the Wednesday birth-date system. This older payment rule is still active and continues to apply in 2026.

Because of these different groups, two people receiving Social Security may be paid on different days even though they receive the same type of benefit.

How the 2026 Cost of Living Increase Appears in Payments

Most years, Social Security benefits are adjusted through a Cost-of-Living Adjustment. This increase is designed to help benefits keep up with inflation and rising prices. When a COLA is approved, it is automatically added to monthly payments starting in January of that year.

That means February 2026 payments already include the updated amount. Beneficiaries do not need to file a separate request to receive the increase. The adjustment is applied automatically based on each person’s benefit record.

The percentage increase is the same across the program, but the dollar change is different for each person. Someone with a higher base benefit will see a larger dollar increase than someone with a smaller base benefit. Comparing December and January deposits is often the easiest way to see how the adjustment changed the payment amount.

Common Reasons a Payment Might Be Late

Most Social Security and SSI payments arrive on time, but delays can sometimes happen. One common reason is outdated or incorrect bank information. If a financial account was closed or changed and the update did not reach the agency in time, the payment may not post correctly.

Bank processing delays can also play a role. Sometimes a deposit is sent on schedule but appears in the account a bit later due to internal bank review or posting times. Holidays and weekends can also affect when funds show up.

Administrative reviews or identity verification requests may temporarily pause payments in rare cases. If a recipient recently updated personal details, address information, or citizenship records, processing checks could affect timing.

What Steps to Take If Funds Do Not Arrive

If a payment does not appear on the expected date, the first step is to check the bank account or payment card history carefully. It is also helpful to review any recent letters or online notices about account changes or verification requests.

The next step is to log into the official Social Security online account to review payment status and history. Many deposit details are visible there, including scheduled payment dates.

If the payment is still missing after checking these sources, contacting the Social Security Administration directly is the best option. A representative can review the record and explain what happened or what action is needed.

Why Knowing the Payment Calendar Matters

Understanding the monthly payment structure makes financial planning easier. SSI is generally paid at the start of the month, while retirement and disability benefits are tied to birth dates or older enrollment rules. Once beneficiaries know which category they fall into, they can estimate future deposit dates with reasonable accuracy.

Relying on official sources instead of rumors or social media posts is very important. Unverified claims often create confusion about extra payments or schedule changes. Official program channels provide the most reliable and updated information.

Conclusion

The February 2026 Social Security and SSI payment schedule follows the same structured system used in recent years. SSI is typically paid at the beginning of the month, while retirement and SSDI benefits are sent based on birth-date groups or the pre-1997 rule. Annual cost-of-living increases are already built into monthly deposits for 2026, so beneficiaries should see the updated amounts.

Keeping bank details current, checking official account records, and understanding the payment calendar can help ensure smooth and timely access to benefits. With the right information, recipients can better manage their monthly finances and avoid unnecessary worry.

Disclaimer

This article is provided for general informational purposes only. It does not replace official guidance or personal records from government agencies. Payment dates and benefit amounts depend on individual eligibility and official Social Security Administration data. For exact and personalized details, always check your official account or contact the appropriate government office directly.